On 7th June 2016, the Cabinet approved the draft of the Land and Building Tax Act (the “Draft Act”) which was proposed by the Ministry of Finance. The main purposes of the Draft Act are as follows:

As tax collections under the Building and Land Tax Act B.E. 2475 and the Local Maintenance Tax Act B.E. 2508 are now out of date and impractical, the Draft Act is intended to supersede these Acts and to implement collection of a new tax on a progressive rate and on an annual basis, when it is enacted. The significant tax collection under the Draft Act is summarized as follows:

The tax payer under the Draft Act is an owner of land, building or apartment unit or a tenant of land or building of state.

The Tax collector under the Draft Act is the Local Administration which consists of Municipality, Sub-district Administrative Organization, Bangkok Metropolitan Administration, Pattaya City Administration.

The tax base under the Draft Act is a value of land, building or apartment unit. The value of each property can be calculated from its official appraisal price multiply by its area.

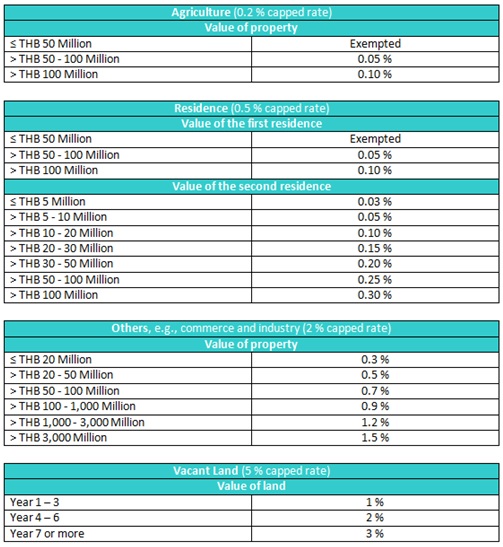

The tax rate under the Draft Act depends on nature of property use which is separated into 4 categories, being Agriculture, Residence, Others and Vacant Land. The Draft Act provides only the capped rate of each category. The actual tax rate shall be specified in the Royal Decree to be issued under the Draft Act. According to the Ministry of Finance, the actual tax rate of each category will be as follows:

Please note that the above summary is compiled with reference to disclosure materials of the Ministry of Finance, as the Draft Act is not public yet. The Draft Act was initially intended to be enforced at early 2017. However, on 20th November 2016, the Minister of the Ministry of Finance advised that the enforcement of the Draft Act shall probably be postponed to early 2018 as interpretations of the Council of State are different from interpretations of the Ministry of Finance. As such, the Ministry of Finance must take time to review the Draft Act before further proposing it to the National Legislative Assembly for its consideration and approval.

We will keep you updated on further developments of the Draft Act.

Should you have any queries, please do not hesitate to contact us.

THAILAND ADDRESS

THAILAND ADDRESS

5th Floor, Zuellig House 1-7 Silom Road, Silom Bangrak, Bangkok 10500 Thailand

Tel : +66 2 6360585

Fax : +66 2 6360587

E-mail : enquiries@southasia-law.com

MYANMAR ADDRESS

MYANMAR ADDRESS

No. 791, Lower Phone Gyi Road, Lanmadaw Township, 11191, Yangon, Myanmar

Tel :

Fax :

E-mail : enquiries@southasia-law.com